Twitter has introduced a brand new shareholder rights plan in a transfer often called a poison tablet, as a approach to block Elon Musk’s $41 billion buyout provide. The plan, as reported by The Verge, would permit sure shareholders to buy extra inventory in response to anybody attempting to achieve management of the corporate via the open market.

The transfer was introduced in a Twitter press launch, which says the Twitter board adopted the plan in response to “an unsolicited, non-binding proposal to accumulate Twitter.” Listed within the press launch as a restricted period shareholder rights plan, the maneuver is understood within the finance world as a poison tablet and is never carried out, and much more hardly ever triggered.

The plan will stay in impact for the following yr, and can solely be triggered if Musk acquires greater than a 15% share of possession within the firm. If the plan had been triggered, it will require Musk to spend an growing amount of cash to take care of a majority stake within the company–though the billionaire has prompt that he could also be prepared to throw growing quantities of money on the firm.

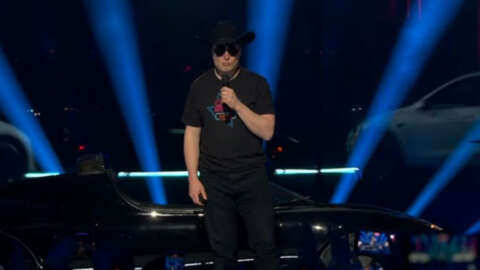

Elon Musk’s historical past with Twitter goes again a good distance, however got here to a head not too long ago when he quietly grew to become the corporate’s largest shareholder. He initially accepted a seat on the corporate’s board with the situation that he could be unable to buy greater than a 15% share of the corporate, however he later backed out of the provide and launched a hostile takeover bid.

Musk has critisized the prospect of board motion towards his provide, saying that it “could be totally indefensible to not put this provide to a shareholder vote,” and has threatened to dump his shares within the firm if the provide just isn’t accepted. In a TED interview, Musk has stated that his plans for Twitter contain preserving the platform as a spot totally free speech.