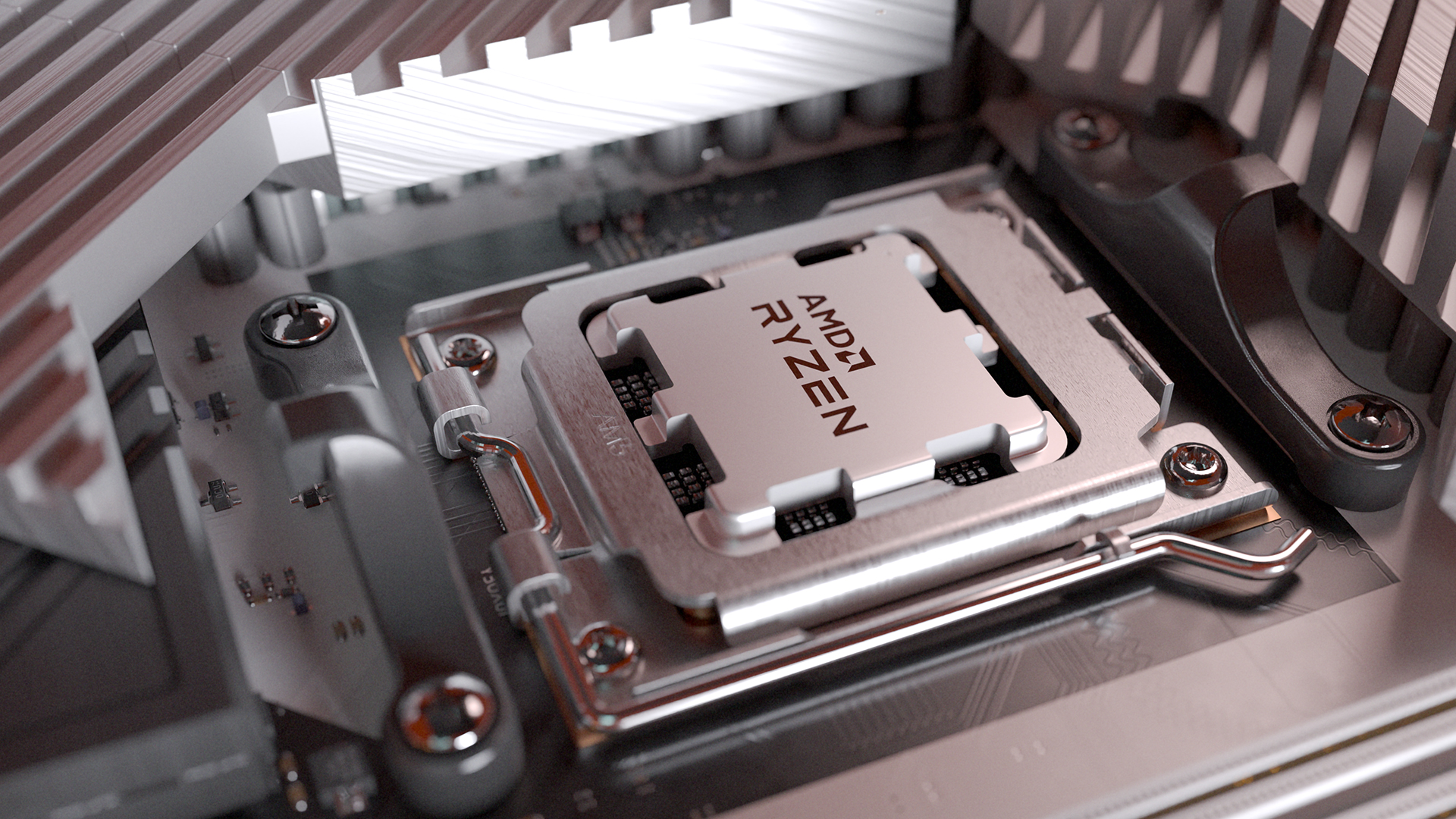

AMD has confirmed the Q3 launch window for its upcoming Ryzen 7000 collection CPUs and “high-end RDNA 3 GPUs later this yr.” This comes from the current Q2 2022 earnings name the place it mentioned the corporate’s financials, supplied ahead steerage and, most significantly for us avid gamers, doubled down on once we can get our fingers on new crimson group {hardware}.

AMD CEO Dr. Lisa Su confirmed its 5nm Ryzen 7000 collection CPUs (opens in new tab) will launch later this quarter. And, if that is the case, the chances look good for a September launch, which is mere weeks away now. Dr. Su additionally made a efficiency prediction, stating the corporate expects “management efficiency in gaming and content material creation.” An fascinating declare, and one we will not wait to check ourselves.

AMD additionally confirmed it plans to launch high-end RDNA 3 GPUs (opens in new tab) later in 2022. Dr. Su acknowledged that “high-end” GPUs will launch first. This implies AMD and Nvidia are all set to battle it out for the outright gaming crown across the identical time.

A December launch in the course of the vacation season would appear unlikely, and if AMD does launch its CPUs in September, then I might wager we’ll see the primary RDNA 3 playing cards in November.

With an all new CPU platform and GPU structure, AMD seems to be to have a robust portfolio in place for the patron market, and it is wanting good for the enterprise market too. AMD’s EPYC Genoa CPUs are on monitor to launch later this yr, too. Do you fancy a 96-core CPU? AMD says it has robust curiosity from clients for its Genoa vary, and AMD could possibly be set to make the most of additional delays to Intel’s competing Sapphire Rapids vary.

Shifting onto the monetary facet, AMD posted document revenues (opens in new tab) for the second quarter of 2022 which is an enormous 70% improve year-on-year. It contrasts closely with Intel’s weak Q2 report (opens in new tab), and comes throughout a troublesome time, with a weakening economic system, submit pandemic points, and worsening inflation.

Sturdy outcomes got here from its information centre enterprise, with 83% year-on-year income development, which meant that working earnings greater than doubled to $472 million from $204 million the earlier yr.

Its shopper dealing with enterprise continues to be the corporate’s most important earner, nevertheless. That features each desktop and pocket book CPUs; with working earnings up 26% year-on-year to $676 million. AMD cited robust gross sales of its cell Ryzen CPUs as a significant contributor.

Regardless of the seemingly excellent news, AMD was downbeat concerning the outlook for the remainder of the yr. It believes that softening demand and stock build-up may negatively affect its monetary place. This can be a widespread theme amongst tech firms in 2022.

For now, AMD is in a robust place however whether or not it’ll keep that approach is dependent upon the ball and chain of the worldwide economic system and whether or not its merchandise are aggressive. If Intel’s execution points proceed, then AMD may discover itself stealing much more market share from Intel.