BlockchainGamer.biz editor-at-large Jon Jordan has been writing concerning the video games business since 1999. He predicts blockchain is the subsequent nice disruption and in our weekly column he shares his views on the whole lot web3 video games. You’ll be able to learn extra in his Substack and get in touch with him by way of [email protected].

The ability of the peacock’s plumage

As is commonly the case, not interested by the factor you’ve been interested by is the easiest way to return to conclusions.

So it was I used to be pounding the streets with the newest episode of Russ Robert’s EconTalk on my headphones. I like Russ.

Definitely he’s no Tyler Cowen however who’s?

Tyler is a person whose output is researched to the extent lots of his visitors are so confused how expertly he formulates after which dissects their views, they stroll straight into their very own mental cul-de-sacs. Peter Singer and Noam Chomsky being current examples.

That’s not Russ’ fashion, although. He’s an trustworthy man, banging out podcasts. An economist by coaching, he’s now working a college in Tel Aviv and internet hosting EconTalk — tagline “Conversations for the Curious: a part of the Library of Economics and Liberty”.

And on this episode — “Obedience to the Unenforceable“ — he was internet hosting Michael Munger, a self-styled libertarian economist, who was on EconTalk for a document forty fifth time. Nicely, the present has been working weekly since 2006.

Collectively they mentioned a lecture — Regulation and Manners — given by Lord Moulton in 1924 by which he postulated on how a gentleman ought to behave within the center floor between these acts decided by our personal particular person freedoms and people decided by state legislation; what we’d label the sphere of society by which we now have seeming freedom in our actions however which even have implications for different folks.

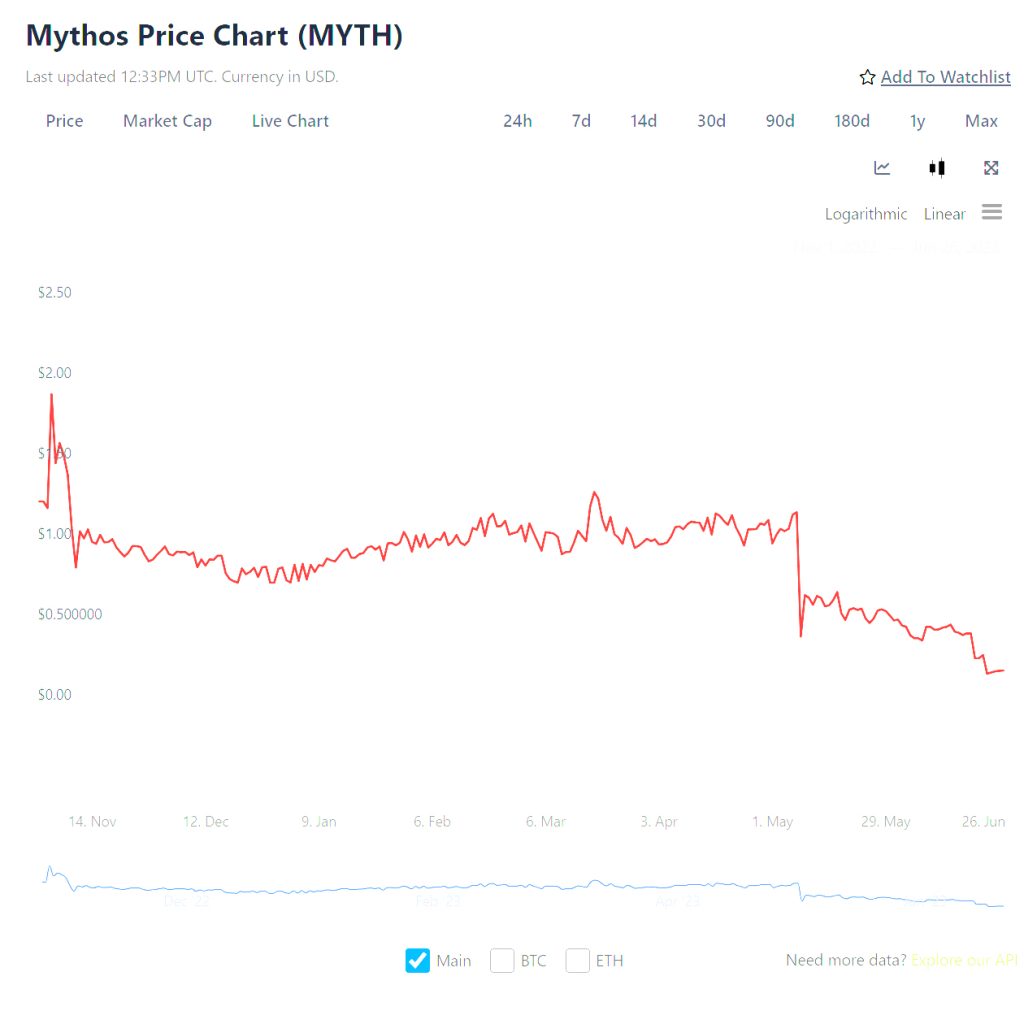

Clearly, my ideas instantly turned to crypto, notably the frustration expressed in Monday’s missive concerning the motion of MEXC’s merchants dumping their free MYTH tokens on the expense of these of us buying and selling MYTH-denominated belongings on the Legendary Market.

The value of MYTH has continued to fall too. It’s now down 91% from its all-time-high at $0.18.

It’s instance of Regulation and Manners as a result of it demonstrates the crux of the problem. The token dumpers consider that within the absence of precise legislation — both state legislation or code as legislation — dumping tokens is solely private freedom.

Nevertheless, these of us downstream of these actions beg to vary due to the counterparty impacts of these token gross sales. Certainly, we’re indignant as a result of we consider our rights as these whose actions within the video games that use the MYTH token (and which ought to basically underpin the MYTH token value) are superior.

And these rights have been trampled — each morally and fiscally — by these merchants’ actions. However a lot for the etiquette lesson.

Can we do something about it?

Not giving such optionality to those that have demonstrated no dedication to the mission in hand could be the plain one!

Extra usually, although, within the absence of any particular person restraint on revenue taking — which most individuals deal with as a person freedom within the absence of code as legislation — initiatives must internalize these classes, guaranteeing that these offering probably the most worth are those who ought to profit from any upside.

And, this being blockchain, that is one thing that may be externalized in code as legislation.

For some time now I’ve been enjoying round with the concept of how a blockchain sport mission might steelman its standing as a longterm play.

Working backwards, it could decide for so far as is humanly doable that the sport would completely run for a sure variety of years (x), with tokens or comparable liquid gameplay belongings solely launched midway via that interval (x/2).

It may additionally be a energy — not a weak point — that such a sport would seemingly be extremely under-capitalized in its early levels.

Therefore a sport improvement staff committing their repute to develop and function a sport for at the very least 10 years would additionally commit to not have reside tokens for five years; the purpose being a sport and its economic system must run for a sure time period earlier than launching a reside token and all of the monetary stresses that include it.

After all, the trustworthy response could be is that this kind of ridiculously inflexible system doable to perform; notably how would such a mission even fund itself?

I don’t know.

However some ideas could be that just like the plumage of a peacock, the primary mission to take action would differentiate itself in an excessive style if solely due to its idiosyncratic nature.

Extra sport, much less tripple-A graphics

Maybe this ridiculous experiment would be capable of fund itself by way of some kind of Kickstarter. An alternative choice could be to doubledown on its inherent lack of brief time period commercialization with supporters and funders sending stablecoins (or different applicable belongings) right into a time-locked good contract that would supply an instantaneous yield funding stream to the dev staff, changing into sport tokens by way of a vesting schedule that aligned with the sport’s x/2 timing.

It may additionally be a energy — not a weak point — that such a sport would seemingly be extremely under-capitalized in its early levels, which might pressure the small part-time staff to deal with the sport’s subsystems and its economic system, not triple-A graphics and all that jazz.

As an apart, this might in all probability be a totally onchain sport that slowly builds out its performance and accessibility, however the level could be that everybody would know the state of affairs. In all probability you’d have an enormous countdown clock on the web site.

And don’t miss out on any information from the blockchain video games area: observe us on Twitter and join with us on Linkedin.