With the discharge of their newest International Gaming Market report, Drake Star Partnershave revealed an entire host of latest insights into the monetary well being of the gaming trade.

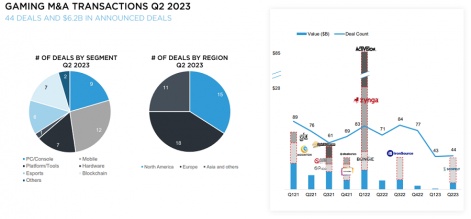

As famous in our earlier protection of their report (obtainable right here), though there appears to be a constant rise in funding and M&A, we’ve seen personal offers dip considerably and the market is but to achieve the massive peaks seen in 2022, the place Q1 boasted 83 offers with their worth primarily pushed by the large Zynga acquisition.

What’s new on the planet of cash?

First issues first we should always study their charts on M&A transactions to date, as this offers a useful timeline on the efficiency of offers in M&A over the previous two years. We are able to see the aforementioned peak in Q1 2022 that has additionally pushed a lot hypothesis about when, or if, the gaming trade goes to get again to that peak within the close to future.

Given the scale of the Activision Blizzard acquisition, which has been anticipated to shut this 12 months, we may even see this peak overcome when that closes. Nonetheless, just like the Zynga acquisition it could additionally imply the height is very weighted in direction of a single firm. So, arguably the ratio for different firms remains to be fairly excessive regardless of the decrease worth general. The drop in offers is also attributed to that top quantity – primarily with a peak of M&A it means we’re prone to see a dip as firms settle in and people serial acquirers search for extra choices within the meantime.

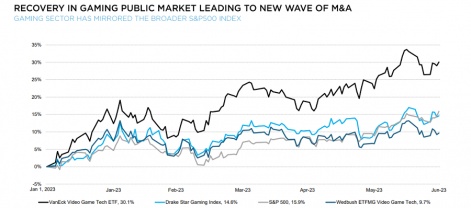

Whereas issues had been a lot leaner within the Jan-Feb interval, as identified by Drake Star we will see a major uptick round march. The S&P 500 as a “broader” index implies that it covers extra than simply the gaming trade, so this rise is together with broader financial developments.

Nonetheless, we will seemingly make a judgement that – if causes for gaming to rise particularly have to be thought-about – the top of the licensing freeze in China and the sluggish however regular progress of the Activision Blizzard acquisition has helped drive this progress.

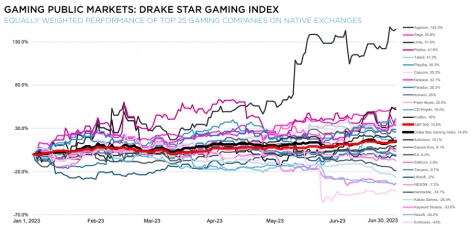

The High 25 gaming firms and their efficiency additionally provides a startling distinction in fortunes for a lot of firms. Applovin for instance started to soar in Might, whereas, naturally Embracer noticed a plummet to rock-bottom after their disastrous financials and the falling via of a $2bn deal in early June. Embracer’s fall is also a motive to think about the lesser variety of M&A offers, as their enterprise mannequin was closely weighted in direction of fixed acquisitions, different contributors could also be rethinking their strikes consequently.

It will appear, judging by the dip within the Drake Star Gaming Index round this level, that Embracer’s high-profile drop in fortunes – in addition to the the poor efficiency of NCSoft and Key phrases Studios, each down greater than 30% – helped to drive down the efficiency of this index. Mockingly it’s the flip-side to the boldness that the at the moment fairly seemingly completion of the Activision Blizzard provides, in that the fortunes of a large firm can both dictate a rise or a drop within the broader market’s efficiency.

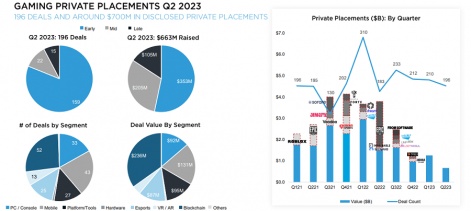

Non-public placements have been comparatively wholesome within the meantime. With This autumn 2021 and Q1 2022 seeing the very best peak within the final two years, as may be seen under. It will appear placements are on a little bit of a downward development after this peak, though nonetheless remaining simply above the identical comparable quarter in 2021.

Total, whereas it appears M&A is certainly again and swinging, it’s but to achieve the identical heights it as soon as did at a peak in 2023. However, as beforehand acknowledged, though it might artificially inflate the index the Activision Blizzard deal won’t simply be good for gaming normally however cellular particularly. All eyes are on what Microsoft does as soon as the acquisition is accomplished, and hopefully which means their anticipated emphasis on cellular will propel funding into the sector.

Definitely, acquisitions resembling Scopely and Rovio by a lot bigger firms have been main tales outdoors of the particular cellular area of interest. So within the absence of different main acquisitions, cellular is main the best way by way of cash.